As seen last week by the doggy, doggy few.

The Cam at Grantchester

Yes, I know all the jokes about “anybody who would marry Quentin…”

This to let you know, gentle reader, that Rose’s book of that name, the third in the Mary Finch series, is officially published tomorrow. We’re having a launch party tonight…

However, rumour has it that it’s already available in certain fine bookshops – Waterstones in Cambridge being an example – and you can also find it at the usual online booksellers. Readers in North America will need to order from the UK, or wait until the US edition is published in the autumn…

Links and more information at RoseMelikan.com…

To the north of Cambridge a new housing estate is being built. Well, it was being built, though things seem to have slowed down a bit recently, presumably because the property market is in the doldrums.

I’ve seen some of the houses, and actually been inside one, and they’re not bad, as modern buildings go. But I have to wonder at the intelligence of the developers.

At first, they named the estate ‘Arbury Park’ – a delightful-sounding name unless you happen to ask a local, in which case you’d discover that Arbury, the estate next door, is, shall we say, not deemed to be amongst the more desirable areas of the city.

After building a large number of houses, I presume that they cottoned on to this because some months ago it was renamed ‘Orchard Park’, a ‘mixed use development including 700 prestige homes’. And they’ve managed to convey just some of this prestige in the proud sign that announces the project to passers-by.

I assumed this was a temporary sign. Very many months ago.

I like the comment on the District Council web site – a wonderful example of dangerous punctuation:

The site will provide 900 quality homes – 270 of which will be ‘affordable’.

Update: Have a look at the comments for some interesting background to the story… and in the afternoon of the day I posted this, I drove past the sign again, to find that it had finally, after many months, been replaced a couple of days before. Which makes it look much more professional, but now, knowing the story, I can’t help but feeling the old one was rather more fun!

Just around the corner from my house, where the footpath from Cambridge to Grantchester begins, is Skaters’ Meadow. In the 19th century, the meadow would flood, freeze, and people would pay a penny or two to skate around the lamppost in the middle (which you can just see if you click it and look at the larger versions on Flickr).

These days, it’s managed as a nature reserve, and is no good for skating, partly because the winters aren’t cold enough any more, but mostly because it very seldom floods. So I snapped this picture after some heavy rain last week; it’s the nearest I’ve yet seen it come to being a skating rink again. There was a little ice around the edges…

Wouldn’t it make a great setting for a story, though?

On wintry nights, it is said that the ghosts of skaters past can sometimes still be glimpsed, twirling under the lamppost in the moonlight. The most beautiful, and the most graceful of all, is young Annie Crompton, a maid at one of the great houses nearby, who mourns the loss of her love, an adventurous lad who skated too far out onto the River Cam, fell through the ice and drowned. She circles endlessly, awaiting his return…

More photos of the meadows here.

On a country walk today, I came across this wonderful beast. It’s hard to get a feel for scale here, but it was very big!

Do you think this is the sort of thing farmers dream of getting when they win the lottery, where others might aspire to Ferrari-ownership?

More rural, autumnal pictures here.

The great thing about travelling, I’ve always thought, is that it makes you realise what you’ve always taken for granted at home. Do light switches go up or down to turn them on? Or do you press them in so that a timer can pop them out again when you’re halfway up the stairs?

One thing I noticed when first visiting the States was how much text is used on road signs compared to here at home. We tend to assume that symbols are better and so will create some complicated series of hieroglyphics to indicate that the road narrows and then turns left, while an American sign would probably say “Road narrows then turns left”.

Symbols do have an advantage if drivers are illiterate, dyslexic, or foreign. And they usually take less space. But they need to be used well. Here’s a sign I pass regularly which, I find, takes some thought:

It faces you as you come to a T-junction, so you at least have time to contemplate it, which is fortunate – it would be more challenging at speed!

For me, as I suspect for many people in this situation, the question I am asking is ‘Can I turn right?’. To the right is a useful route that takes you away from the crowded centre of Cambridge where you’ve just been parked. But it is blocked, a little way down, by bollards which let traffic either in or out of town at different times of day. So what this sign says is that you can always turn right or left, but turning right will lead you to a dead end at certain times. Fine.

However, if you arrive just after lunch thinking, “Can I turn right?”, you see the arrow pointing that way, you see the times, you work out whether you are in that midnight-to-4pm slot and then you think “Hurrah!”, before realising that you’ve worked out the times when you’re not allowed to do that.

I don’t know, maybe it’s just the way my brain works that’s strange. Or maybe it was designed by some local logicians to keep people like me on their toes. I think it’s a Microsoft road sign. Lots of different ways to do things and some of them unnecessarily complex.

How would Apple design this? I think the sign would just have a single elegant left arrow. They’d say, “Sorry, that’s the only way you can go. No right-button clicks here. I know that seems restricting, but trust us, it’s for your own good. And doesn’t this sign look beautiful?”

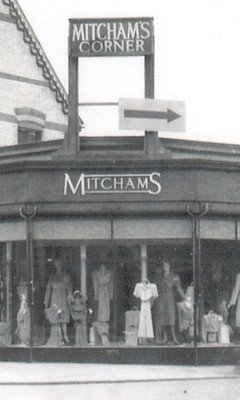

Cantabrigian readers might enjoy a site I’ve just found, Andrew Brett’s Cambridge Back Chat. It’s a fine collection of local history blog posts on a variety of subjects… I, for one, didn’t know that Mitcham’s Corner was named after a clothes shop that used to stand there. Here’s another view.

Cantabrigian readers might enjoy a site I’ve just found, Andrew Brett’s Cambridge Back Chat. It’s a fine collection of local history blog posts on a variety of subjects… I, for one, didn’t know that Mitcham’s Corner was named after a clothes shop that used to stand there. Here’s another view.

The entry I enjoyed most, though, is a very pleasing account of a Bleriot-pattern monoplane landing on Parker’s Piece in 1911.

The full piece is here, and I recommend reading the whole thing, but here’s an extract:

At last Mr Moorhouse gave the word “”Let go,”” and the machine darted forward across the turf at a great pace, heading slightly to the left of the electric light standard in the centre of the Piece. After running about 120 yards the machine was seen to be rising. The wheels were lifting off the grass, and the whole structure was inclining gently upwards. A few yards and she was wholly clear of the ground, and soaring gracefully upwards. It was a beautiful and a wonderful sight to see how the slender fabric seemed to be converted from a thing of earth, struggling as it were to free itself from the invisible bonds that held it down, into a thing of grace and beauty, fairy-like, almost ethereal, freed from grosser things, that seemed to glide through the air as if it were in its native element and to exalt in its freedom from the trammels of earth. There was something awesome in the sight. One seemed to be looking on at the birth of some strange new thing of wondrous possibilities – the dawn of a new era in the history of mankind.

Ah, local papers were worth reading back then!

Things are going well at Camvine.

Of course, we’ve had the usual trials and tribulations that any startup company goes through, exacerbated by the worst economy for decades in which to try and launch a new company with a new product! But we now have an excellent system in our CODA platform, and customers are starting to buy it and deploy it: you might well find yourself in a school corridor, garden centre, industrial factory, hospital waiting room, conference centre, or university faculty, and find yourself looking at information displayed on our internet-connected CODA screens.

So I’m now starting the fun process of raising further investment to take the company to the next stage. In preparation for this, I’ve been picking the brains of VCs, angel investors, executives and other knowledgeable people about the current state of the investment market, and thought I’d note down a few miscellaneous things I’ve heard.

This is a million miles from being a statistically-valid survey. It’s based on a small number of discussions so far. But I offer them in case they’re useful to others in a similar situation, and would welcome comments and further thoughts from others:

Any VC fund that’s been around for a while is likely to have companies already in its portfolio that have been financially challenged over the last couple of years. They may have to support those with extra funding at the moment, rather than taking on new investments. The best opportunities are therefore coming from funds that raised their capital just before the downturn, and haven’t yet spent it all. Even some of those are being cannibalised to support earlier investments. Different funds have different degrees of freedom to do this, but in general it seems to be a common issue.

For those of you who don’t speak VC – I myself am far from fluent – let me attempt to translate. One VC told me that the average time between putting money into a company and some sort of ‘exit’ (when they get their money back) has lengthened – it’s now about eight years. Since many funds operate with a ten-year lifespan, that doesn’t give them much room to manoeuvre. They need to have invested pretty quickly after the start of the fund to be able to tidy things up before the end, and remember that the eight year figure is an average. Some exits will take much longer.

As a result, many are investing in companies that are a bit more mature, even though the potential gains are smaller for the VC, simply to reduce this timespan. This isn’t such good news for startups.

Or rather, they’re coming back. Mark Littlewood gathered some statistics together in a very interesting post recently.

Or rather, they’re coming back. Mark Littlewood gathered some statistics together in a very interesting post recently.

The numbers suggest that venture investments in the US, in particular, tumbled dramatically from a peak in mid-2007 to a nadir at the end of 2008, but are rebounding with equal gusto now. Even back in January an executive bubbled enthusiastically to me on the phone. “Here in California it feels as if the recession finished six months ago!” She may be right, but others have told me there’s precious little appetite at present for investing in European companies, so those of us on this side of the pond need to look for funds closer to home.

Mark’s statistics also suggest that European deals have fluctuated much less during this period than might have been expected, and certainly less than the US, though the UK perhaps more than anywhere else has followed the American rollercoaster ride. That’s the special relationship for you.

Doing a deal with a VC has always been a somewhat Faustian affair, and even if you avoid actually selling your soul to them, you may need to sell your shirt to pay your lawyers. One long-established Cambridge VC firm who shall remain nameless became something of a local laughing stock recently when they presented a modest-sized company with a term sheet that ran to 290 pages! But the VC route can be hard to avoid if you’re needing to grow fast.

I’ve generally worked on a rough rule of thumb that you can raise about £600K, maybe a bit more, from angel investors or groups of angels, and that VCs start to be interested once you get over about £1.5M. A million pounds is therefore the hardest amount to raise, and you either need to do it in smaller chunks or present a bigger, more dramatic vision, get more funding, and suffer more dilution than you might want at this stage. That, at least, has been my thinking.

But I was very encouraged when speaking to two separate CEO friends recently, each of them running a company which must have taken a few million in funding, to discover that they had both done it entirely on angel funding, sometimes with the help of government grants. Camvine has been blessed thus far with excellent angel investors who have been supportive at the right times and also asked the difficult questions when they needed to be asked. Angels can also generally move much faster than VCs when timing is tight. The idea that such a model might be something that could be extended much further than I had previously imagined was most encouraging.

So, for now, we’re expecting to raise this next round from individuals rather than institutions. I’m hoping that people will have realised their savings aren’t earning any interest in the bank, and that now is a great time to be investing in companies who have a product to sell as the economy starts to turn upwards again. (Though I’d also be keen to talk to any VCs who want to prove me wrong on any of the above assertions!)

Hope this is useful to somebody out there!

I’m very impressed at what the Cambridge University Office of Communication have been up to recently. There’s a wonderful selection of stuff on iTunes U (which is now easy to access directly on an iPhone or iPod Touch).

But I’ve also just discovered the Cambridge University YouTube Channel which also has much of the same material in a different layout. The quality is excellent.

There are some lovely shorts produced by Windfall Films, too, in the Cambridge Ideas playlist. Here’s six minutes of my pal David Mackay:

Well, OK, landlines are almost gone already, but their demise took another big step closer with AT&T’s testing of a $150 3G femtocell.

If femtocells haven’t played a big role in your life so far, let me explain, because they probably will do in the future. These are little cellphone base stations that you plug into your broadband network and, hey presto, give you mobile coverage in your home or office. Your phone can use them in just the same way as it would use a traditional cellphone tower, and the calls get routed over the broadband to the mobile service provider. Goodbye DECT.

I live about a mile from the centre of the UK’s high-tech hub, Cambridge, and still get pretty patchy coverage in my house from most of the major providers. It’s a disgrace, but soon devices like these will allow us to fix the phone companies’ failings. At our own cost, of course, but that’s better than not being able to make calls at all.

Anyone trialling them in the UK?

Cambridge was a seething, bubbling broth of tourists and language students today – more than I can remember in a long time. They were trying to go in all of these directions. At once. I had to push my bike along a few streets because it was pointless trying to ride it.

Normally I know better than to go into town on a sunny Saturday morning, but I had promised myself a new camera lens. Very pleased with it so far…

This time, the River Cam, on a day when the water was unusually clear.

© Copyright Quentin Stafford-Fraser

Recent Comments